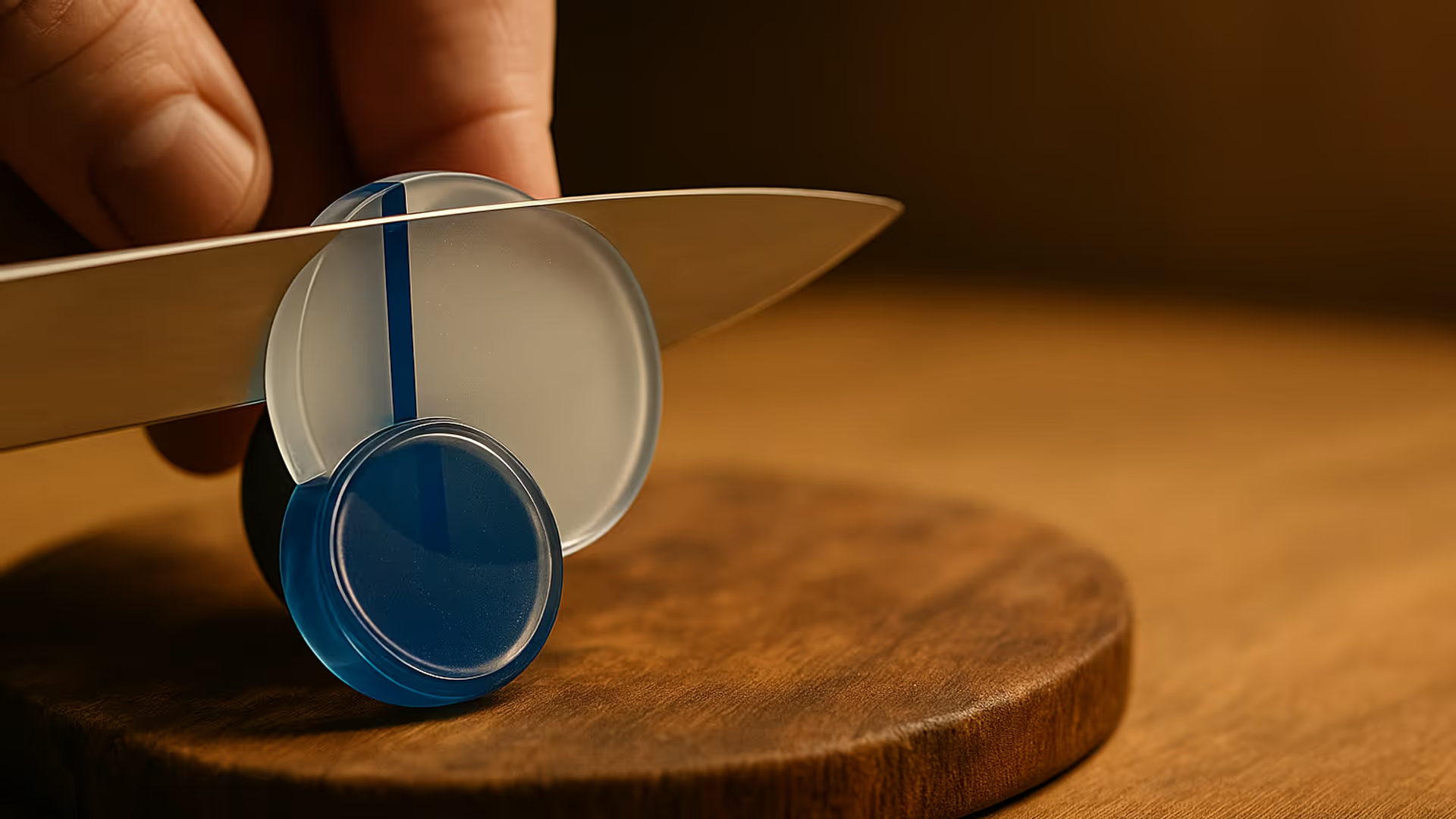

Pendle reimagines yield by letting users split yield-bearing assets into two parts: the Principal Token (PT) and the Yield Token (YT). This separation allows you to trade, speculate on, or hedge against yield independently of the principal—making yield itself a liquid, tradable asset. It’s yield farming with a twist of derivatives.

Pendle’s custom-built AMM is designed specifically for yield markets, accounting for the time-decaying nature of yield tokens. As maturity approaches, the value of YTs naturally shifts—something Pendle’s architecture handles natively. It’s not just another DEX; it’s a clock-smart trading engine for fixed-term DeFi strategies.

Governance on Pendle runs through the vePENDLE model, where users lock tokens for voting power and boosted rewards. This long-term alignment encourages active participation in protocol decisions while distributing incentives to those most committed. In Pendle, governance isn’t passive—it’s productive capital at work.