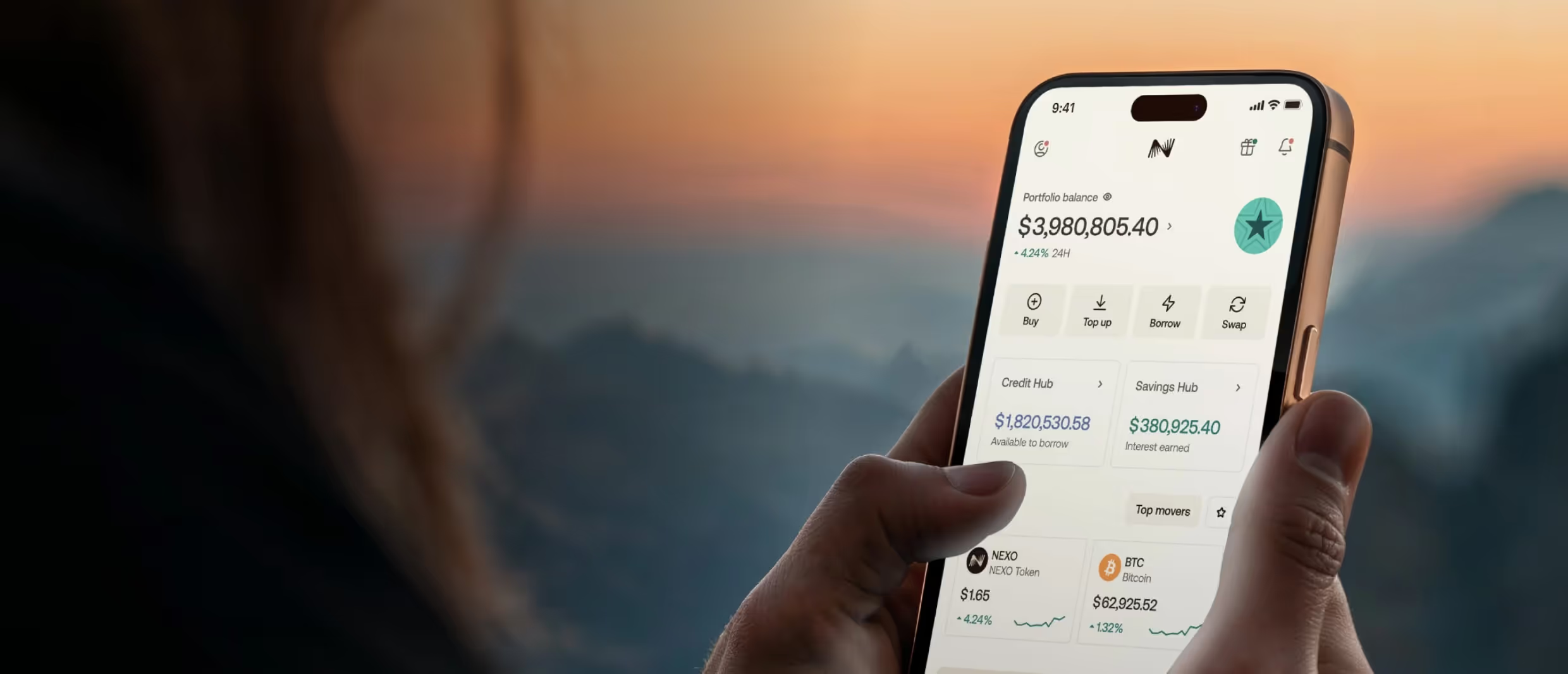

Nexo began its journey in 2018 with a clear goal: to unlock the full potential of digital assets and make financial freedom accessible to all. As cryptocurrencies gained traction, Nexo recognized the need for a trusted bridge between traditional finance and the fast-moving world of crypto. Their platform empowers users to borrow, earn, and trade while keeping full control of their assets, blending security with flexibility. Whether you’re a crypto veteran or just stepping into digital finance, Nexo positions itself as a gateway to smarter wealth management, making it possible to grow and leverage assets like never before.

What sets Nexo apart is its unwavering commitment to trust and innovation. The platform operates on four solid pillars: top-tier security, a customer-first approach, long-term value creation, and relentless product development. From partnering with industry-leading custodians to pioneering products like the Nexo Card — the world’s first crypto-backed card — Nexo continually pushes boundaries. Their seamless user experience, combined with around-the-clock support and cutting-edge tools like Nexo Pro, has cultivated a loyal, global client base that spans retail investors, businesses, and institutions alike.

What sets Nexo apart is its unwavering commitment to trust and innovation. The platform operates on four solid pillars: top-tier security, a customer-first approach, long-term value creation, and relentless product development. From partnering with industry-leading custodians to pioneering products like the Nexo Card — the world’s first crypto-backed card — Nexo continually pushes boundaries. Their seamless user experience, combined with around-the-clock support and cutting-edge tools like Nexo Pro, has cultivated a loyal, global client base that spans retail investors, businesses, and institutions alike.

Nexo’s growth story is nothing short of impressive. Managing over $11 billion in assets, the platform has expanded its ecosystem through innovative ventures and strategic partnerships. Milestones include the successful launch of Nexo Ventures, which has invested in more than 40 promising blockchain projects, and achieving stringent certifications like SOC 2 Type 2 for data security. With services catering to both individual and institutional clients, Nexo continues to scale, evolving from a pioneering startup to a global player shaping the future of digital finance.

At the heart of Nexo’s ecosystem lies the NEXO Token — a powerful utility token packed with benefits. Holding NEXO unlocks higher yields on savings, lower borrowing rates, and access to the platform’s loyalty tiers, which come with perks like cashback, better interest rates, and fee discounts. Beyond utility, the token offers long-term value through dividends, buyback programs, and eligibility for exclusive promotions like airdrops. Whether used as collateral, staked for rewards, or simply held for benefits, the NEXO Token fuels the platform’s economy and rewards its community for their engagement and loyalty.

At the heart of Nexo’s ecosystem lies the NEXO Token — a powerful utility token packed with benefits. Holding NEXO unlocks higher yields on savings, lower borrowing rates, and access to the platform’s loyalty tiers, which come with perks like cashback, better interest rates, and fee discounts. Beyond utility, the token offers long-term value through dividends, buyback programs, and eligibility for exclusive promotions like airdrops. Whether used as collateral, staked for rewards, or simply held for benefits, the NEXO Token fuels the platform’s economy and rewards its community for their engagement and loyalty.

NEXO Token holders can earn between 4% and 12% annual interest on the tokens they keep in their Savings or Credit Line Wallets. This makes simply holding the token a valuable passive income strategy, with daily interest payouts directly to your Nexo account.

NEXO Token holders can earn between 4% and 12% annual interest on the tokens they keep in their Savings or Credit Line Wallets. This makes simply holding the token a valuable passive income strategy, with daily interest payouts directly to your Nexo account.

The NEXO Token powers Nexo’s tiered Loyalty Program, which offers progressively better perks depending on how many tokens you hold. Benefits include higher yields on crypto and fiat balances, lower borrowing rates, free crypto withdrawals, and cashback rewards on transactions made with the Nexo Card.

The NEXO Token powers Nexo’s tiered Loyalty Program, which offers progressively better perks depending on how many tokens you hold. Benefits include higher yields on crypto and fiat balances, lower borrowing rates, free crypto withdrawals, and cashback rewards on transactions made with the Nexo Card.

Holding NEXO Tokens boosts yields not just on NEXO itself but also on other assets in Nexo’s Earn Interest product. This means you can maximize your passive income potential across your entire portfolio, with enhanced rates on stablecoins, crypto, and fiat balances.

Holding NEXO Tokens boosts yields not just on NEXO itself but also on other assets in Nexo’s Earn Interest product. This means you can maximize your passive income potential across your entire portfolio, with enhanced rates on stablecoins, crypto, and fiat balances.

Nexo’s 2025 Growth Plan focuses on expanding its global footprint and deepening the utility of its ecosystem. The platform is enhancing the Nexo Card with global availability, new cashback features, and premium brand partnerships. At the same time, they’re increasing the value of the NEXO Token through initiatives like Launchpools for new projects, revamped loyalty rewards, and additional exchange listings. Leveraging AI-powered tools, automated portfolio management, and multi-asset collateral options, Nexo aims to elevate the user experience across trading and wealth management. With an expanded core offering and new solutions for businesses, Nexo is positioning itself as a leader in global digital finance.

Nexo’s 2025 Growth Plan focuses on expanding its global footprint and deepening the utility of its ecosystem. The platform is enhancing the Nexo Card with global availability, new cashback features, and premium brand partnerships. At the same time, they’re increasing the value of the NEXO Token through initiatives like Launchpools for new projects, revamped loyalty rewards, and additional exchange listings. Leveraging AI-powered tools, automated portfolio management, and multi-asset collateral options, Nexo aims to elevate the user experience across trading and wealth management. With an expanded core offering and new solutions for businesses, Nexo is positioning itself as a leader in global digital finance.