Curve Finance is a decentralized exchange (DEX) and automated market maker (AMM) designed for efficient trading of stablecoins and similar assets. Launched in 2020, Curve Finance operates on the Ethereum blockchain and compatible EVM sidechains/L2s. It specializes in facilitating low-slippage swaps between assets of similar value, such as stablecoins or wrapped versions of the same cryptocurrency, making it a cornerstone in the decentralized finance (DeFi) ecosystem.

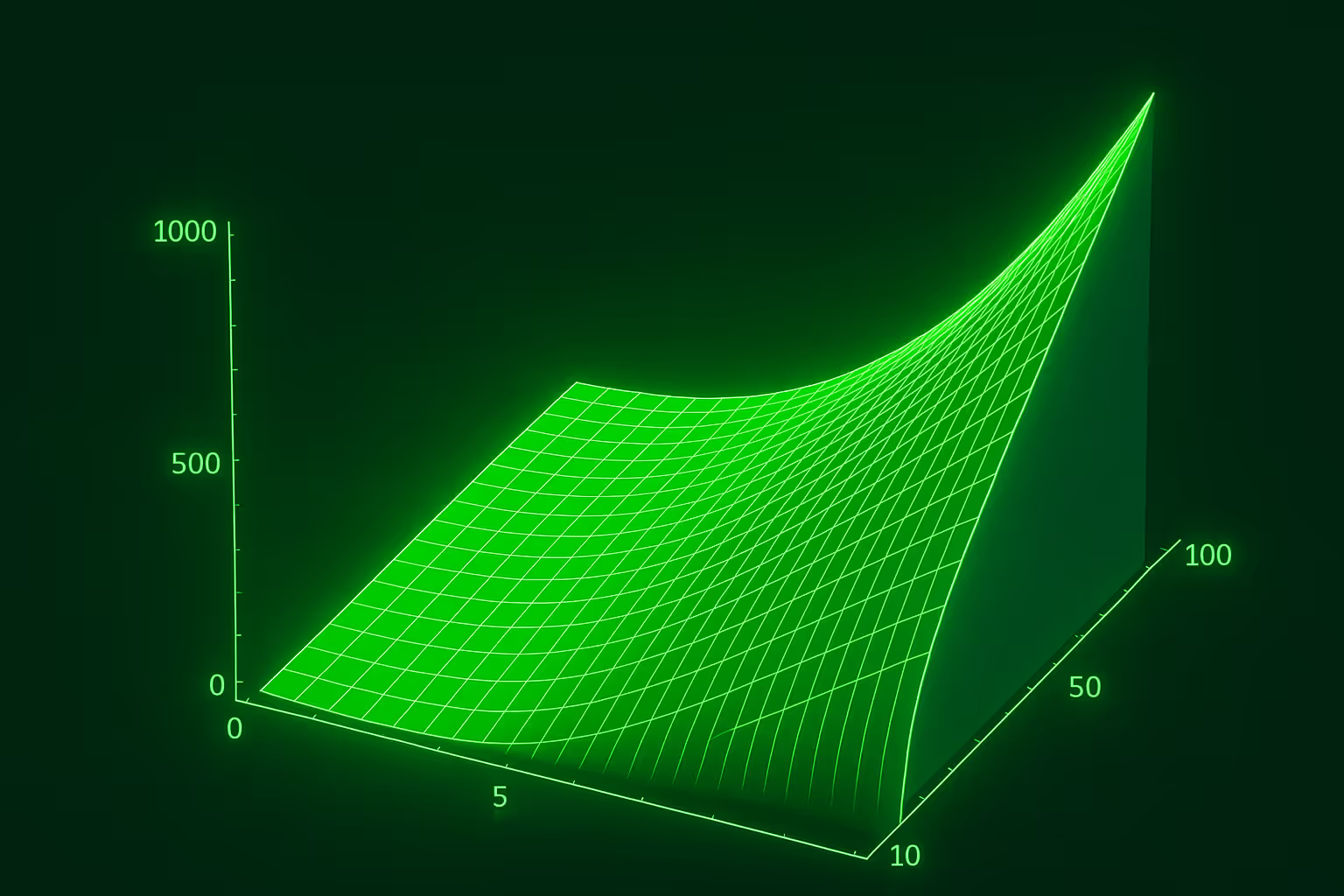

Curve employs advanced bonding curves to maintain stable and predictable pricing between assets. A bonding curve is a mathematical function that defines the relationship between the price and supply of a given asset. In the context of Curve Finance, these curves are meticulously designed to optimize trading between assets that should theoretically have the same value, such as different stablecoins pegged to the U.S. dollar. This approach minimizes slippage and provides traders with more predictable and favorable rates.

CRV is the native token of Curve Finance, serving both governance and incentive functions within the ecosystem. Introduced in August 2020, the CRV token empowers holders to participate in the governance of the Curve DAO, influencing decisions on protocol upgrades, fee structures, and pool parameters. Beyond governance, CRV incentivizes liquidity providers by rewarding them for contributing to Curve's pools, thereby ensuring ample liquidity and the platform's ongoing success.

CRV is the native token of Curve Finance, serving both governance and incentive functions within the ecosystem. Introduced in August 2020, the CRV token empowers holders to participate in the governance of the Curve DAO, influencing decisions on protocol upgrades, fee structures, and pool parameters. Beyond governance, CRV incentivizes liquidity providers by rewarding them for contributing to Curve's pools, thereby ensuring ample liquidity and the platform's ongoing success.

Curve's platform hosts multiple liquidity pools, each designed to facilitate efficient trading between specific pairs or groups of assets. For instance, pools may consist of different stablecoins like USDC, USDT, and DAI, or various wrapped Bitcoin tokens such as wBTC and renBTC. This specialization allows users to trade large volumes with minimal price impact, a significant advantage for DeFi participants seeking stability and efficiency.

Curve Finance has established itself as a fundamental component of the DeFi landscape, providing essential liquidity and fostering innovation. By focusing on low-slippage swaps between similarly valued assets, Curve has become a go-to platform for traders and liquidity providers alike. Its innovative use of bonding curves and commitment to decentralized governance through the CRV token exemplify the transformative potential of DeFi protocols. As the ecosystem evolves, Curve's emphasis on stability and efficiency positions it as a lasting and influential player in the decentralized financial landscape.