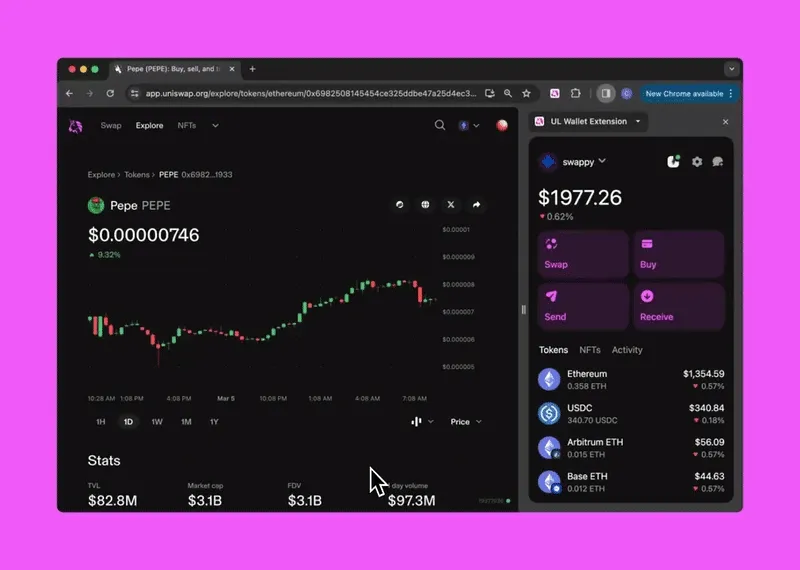

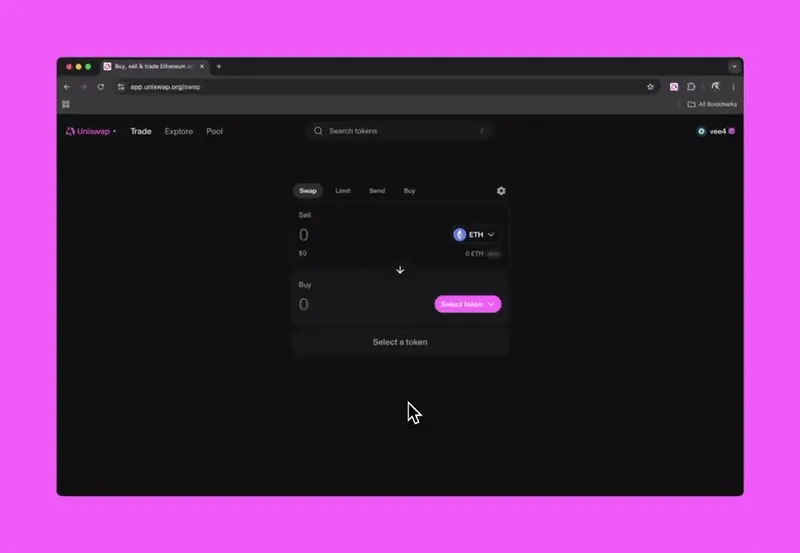

Uniswap is the largest decentralized exchange on Ethereum, facilitating billions of dollars in trading volume every week through an automated market maker (AMM) system. Instead of traditional order books, Uniswap uses liquidity pools where users supply token pairs, making markets accessible to anyone with a crypto wallet. This approach eliminates intermediaries, allowing for fast, trustless swaps of ERC-20 tokens directly on-chain. Since its launch in 2018, Uniswap has processed over $2 trillion in lifetime volume and supports thousands of token pairs, giving users deep liquidity across the crypto landscape. By empowering everyday users to become liquidity providers and earn fees, Uniswap has become a foundational piece of DeFi infrastructure. Its open, transparent smart contracts ensure that every trade is verifiable and permissionless, setting the standard for decentralized trading.

Uniswap plays a critical role in bootstrapping new crypto projects by giving tokens instant liquidity without requiring centralized exchange listings. Startups and DAOs alike can launch directly into the market, while users enjoy 24/7 global access to token swaps without custodial risk. Uniswap’s contracts have been deployed across multiple networks, including Ethereum mainnet, Arbitrum, Optimism, Polygon, and even non-Ethereum ecosystems like BNB Chain, extending its reach across blockchain ecosystems. On average, Uniswap processes over $1 billion in daily trading volume and consistently ranks among the top decentralized finance protocols by total value locked (TVL). Developers frequently integrate Uniswap’s liquidity into their own dApps, powering everything from lending platforms to on-chain derivatives. By lowering the barriers to liquidity and ensuring anyone can trade at any time, Uniswap strengthens the entire crypto economy.

The UNI token gives holders direct influence over Uniswap’s future, transforming the protocol into one of the largest experiments in decentralized governance. Launched in September 2020 via an airdrop to early users and liquidity providers, UNI empowers holders to vote on key proposals, from technical upgrades to how the community treasury is allocated. The Uniswap DAO has already directed millions of dollars toward ecosystem grants, developer tooling, and initiatives to expand Uniswap’s presence across multiple chains. With a community treasury exceeding $2 billion at its peak, UNI holders have substantial resources at their disposal to fund protocol growth. Governance participation is open and transparent, with active discussions and proposals happening regularly on the Uniswap governance forum.

The UNI token gives holders direct influence over Uniswap’s future, transforming the protocol into one of the largest experiments in decentralized governance. Launched in September 2020 via an airdrop to early users and liquidity providers, UNI empowers holders to vote on key proposals, from technical upgrades to how the community treasury is allocated. The Uniswap DAO has already directed millions of dollars toward ecosystem grants, developer tooling, and initiatives to expand Uniswap’s presence across multiple chains. With a community treasury exceeding $2 billion at its peak, UNI holders have substantial resources at their disposal to fund protocol growth. Governance participation is open and transparent, with active discussions and proposals happening regularly on the Uniswap governance forum.

UNI has a capped total supply of 1 billion tokens, distributed over a four-year period, with an ongoing 2% annual inflation rate introduced afterward to sustain long-term participation. At launch, 60% of the supply was allocated to the Uniswap community, including early users, liquidity providers, and active contributors, while the remaining portion went to core contributors, investors, and advisors. This broad distribution ensures that governance power remains in the hands of the ecosystem rather than being concentrated among insiders. Liquidity mining programs have played a key role in deepening Uniswap’s liquidity, incentivizing users to provide stable pools across a variety of token pairs. The Uniswap treasury, governed by UNI holders, funds development grants, user education, cross-chain deployments, and protocol improvements to keep the ecosystem evolving. Through careful design, UNI’s tokenomics balance early incentives with sustained, community-driven growth.

UNI holders vote on key proposals that shape Uniswap’s future, including upgrades, liquidity incentives, treasury allocations, and cross-chain deployments.

UNI holders vote on key proposals that shape Uniswap’s future, including upgrades, liquidity incentives, treasury allocations, and cross-chain deployments.

Through decentralized governance, UNI holders decide how to deploy Uniswap’s community treasury, funding ecosystem growth, developer grants, integrations, and education initiatives.

Through decentralized governance, UNI holders decide how to deploy Uniswap’s community treasury, funding ecosystem growth, developer grants, integrations, and education initiatives.

While current swap fees go to liquidity providers, UNI holders have the power to activate the protocol fee switch, potentially redirecting a portion of trading fees to the treasury or directly benefiting UNI holders.

While current swap fees go to liquidity providers, UNI holders have the power to activate the protocol fee switch, potentially redirecting a portion of trading fees to the treasury or directly benefiting UNI holders.

Owning UNI offers more than speculative upside — it gives holders real influence over Uniswap’s roadmap and economic design. UNI holders vote on crucial proposals, from liquidity incentives to cross-chain deployments and protocol fees. While Uniswap’s current 0.3% swap fee goes to liquidity providers, governance can activate the protocol fee switch, potentially redirecting revenue to the DAO treasury or UNI holders. As Uniswap expands across chains and layer-2 networks, UNI governance becomes even more significant in shaping how value flows through the platform. Holding UNI means direct participation in one of DeFi’s most active DAOs, with the power to shape the future of crypto’s largest decentralized exchange.