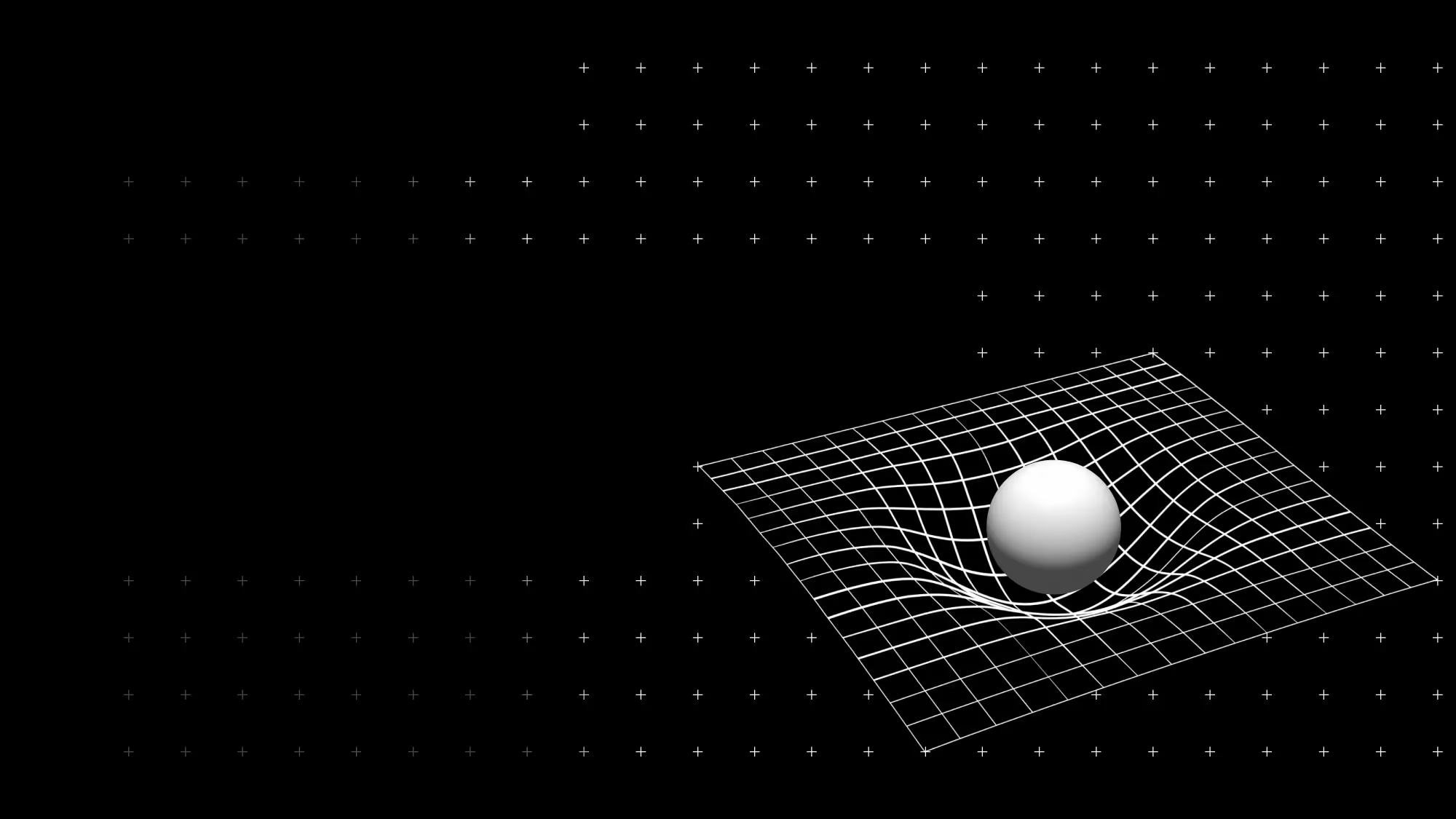

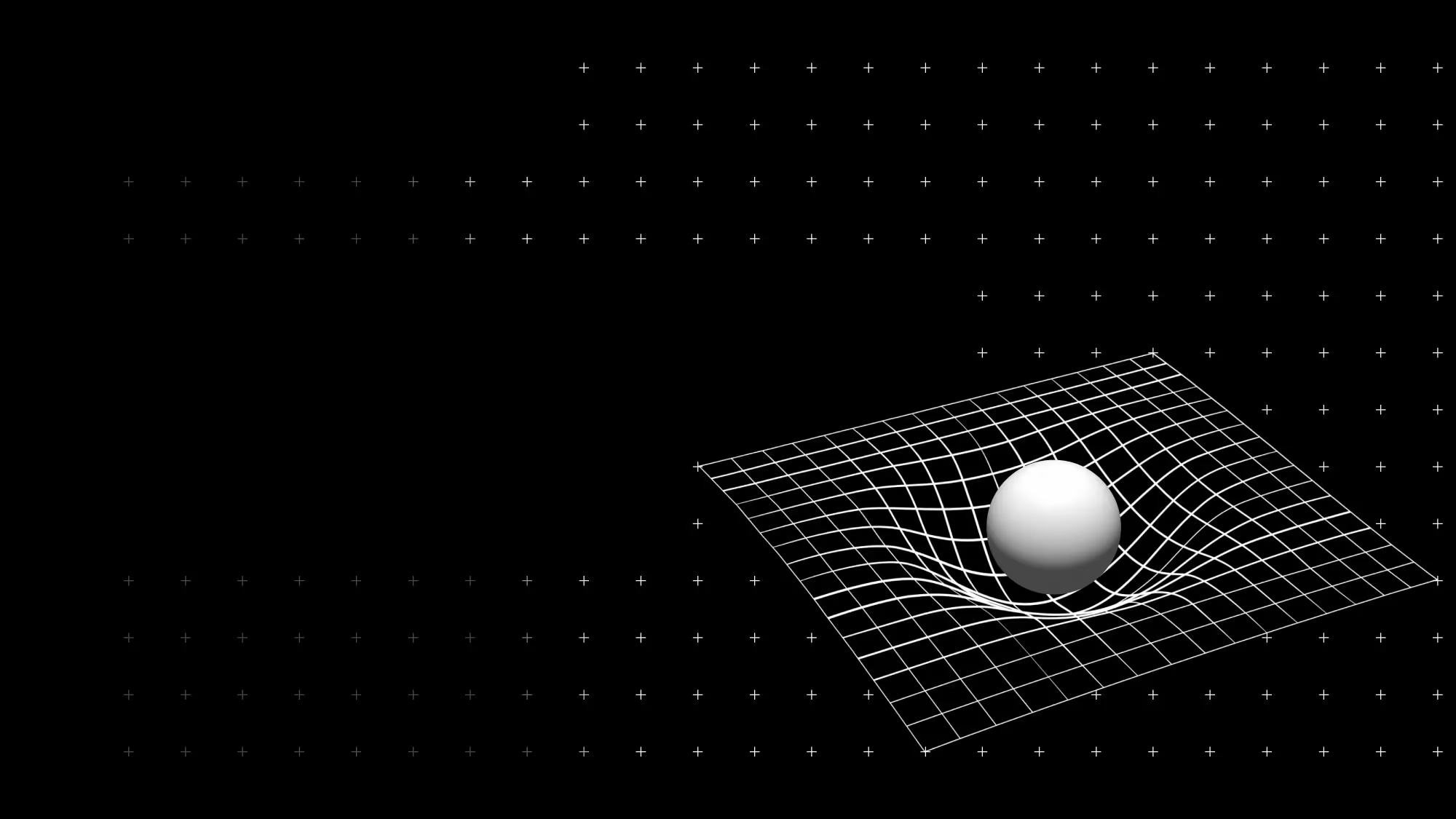

Ampleforth (AMPL) is an adaptive digital currency designed to serve as a decentralized, censorship-resistant unit of account. Unlike stablecoins like USDC or DAI that are pegged to fiat and rely on collateral, AMPL uses algorithmic supply adjustments to stabilize its price over time — no central backing, no reserves. Its price target (based on the 2019 USD) remains constant, but the number of tokens in circulation changes daily based on demand. This elasticity makes AMPL fundamentally different from fixed-supply assets like Bitcoin or inflationary fiat currencies. It fills a missing piece in the crypto economy: a decentralized, rules-based currency that can be used for contracts, pricing, and lending—without relying on centralized intermediaries or collateral.

AMPL’s standout feature is its “rebase” mechanism—a daily adjustment to every wallet’s token balance, triggered automatically when the price strays from the target. When AMPL trades above $1, more tokens are proportionally distributed; when it trades below, token counts shrink. Importantly, this does not dilute or favor any holder—your percentage share stays the same. This shifts volatility from price to quantity, creating a currency that maintains long-run purchasing power while remaining decentralized and composable. It’s especially useful in economic models that require predictable value over time but don’t want to depend on collateral, price pegs, or custodians. In essence, it’s a monetary primitive built to adapt, not break.

AMPL is already being used across DeFi as a non-collateralized building block. It can serve as an inflation-resistant unit of account for contracts, loans, or payments, making it useful for stable-value lending without the risk of liquidation or overcollateralization. In the case of SPOT—a decentralized flatcoin built on top of AMPL—the token’s supply elasticity allows it to function as base collateral for new types of stable assets that are immune to fiat exposure or regulatory capture. AMPL’s predictable supply rules also make it valuable in algorithmic monetary experiments, reserve systems, and cross-chain settlements. Its rebasing model opens the door to novel financial instruments, like rebase-yield farming or dynamic collateral baskets, that would be impossible with fixed-supply tokens.

AMPL is already being used across DeFi as a non-collateralized building block. It can serve as an inflation-resistant unit of account for contracts, loans, or payments, making it useful for stable-value lending without the risk of liquidation or overcollateralization. In the case of SPOT—a decentralized flatcoin built on top of AMPL—the token’s supply elasticity allows it to function as base collateral for new types of stable assets that are immune to fiat exposure or regulatory capture. AMPL’s predictable supply rules also make it valuable in algorithmic monetary experiments, reserve systems, and cross-chain settlements. Its rebasing model opens the door to novel financial instruments, like rebase-yield farming or dynamic collateral baskets, that would be impossible with fixed-supply tokens.

While AMPL’s monetary policy is automated, the evolution of the broader protocol is governed by FORTH, Ampleforth’s governance token. FORTH holders can vote on upgrades, integrations, treasury usage, and parameter changes, helping the protocol adapt without compromising its core principles. This two-token system splits monetary function (AMPL) and governance function (FORTH), allowing AMPL to remain algorithmic and neutral, while still enabling community-driven oversight. FORTH empowers holders to guide the protocol’s direction—whether it’s deploying AMPL to new chains, adjusting the oracle system, or funding ecosystem development. This governance structure ensures that AMPL can remain relevant, secure, and innovative as DeFi grows more complex.

AMPL introduces a radically new monetary model—one that doesn’t rely on trust, collateral, or centralized institutions. In a crypto world increasingly fractured by regulation, overcollateralization risks, and fiat dependencies, AMPL offers a sovereign alternative: a currency that adapts automatically, maintains value over time, and can scale across chains. Its rebasing mechanism allows it to remain composable and interoperable, even as it adjusts supply. As the ecosystem shifts toward flatter, decentralized finance, AMPL is positioned to serve as a foundational unit for DAOs, long-term contracts, and treasury systems that require durability and neutrality. It’s not just a token—it’s an experiment in creating a truly independent form of money for a decentralized world.